Overview:

Private Equity Recruiting in Europe is completely different than it is in the United States.

Have you always wondered how the process looks like in order to break into Private Equity in Europe?

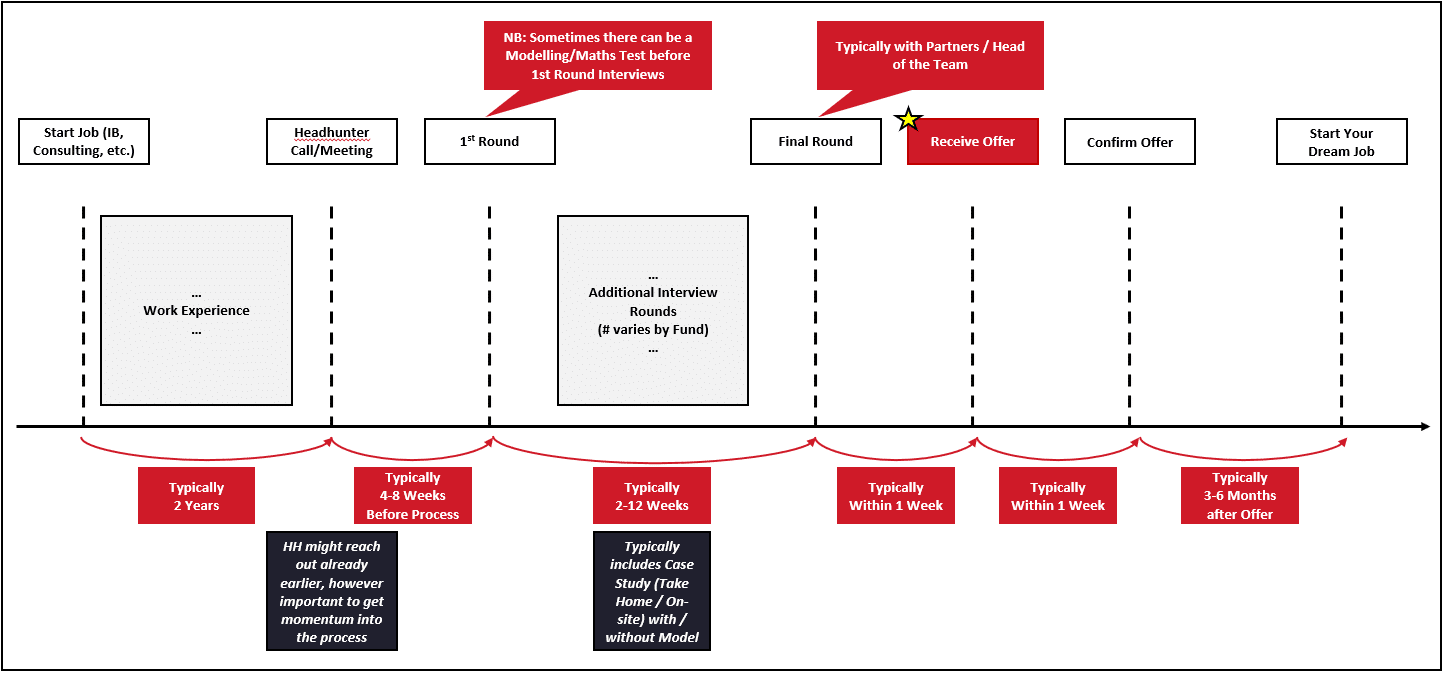

While it differs from fund to fund, there are a few commonalities that can typically (not always!) be observed. An entire process would typically share the following elements:

First, you typically talk to a headhunter. This means you might either get contacted by a headhunter directly (oftentimes as a first approach via LinkedIn or your work email) or you might want to reach out proactively to a headhunter that covers the funds that you are most interested in (check out our headhunter page for more details).

Second, you will get invited for a first round interview. Note that the first round interview can take many forms. Common forms are i) a coffee chat/introductory interview, ii) a “real interview”, iii) a Modelling or Maths Test (similar to what is commonly used for IBD recruiting). Timing-wise, those first round interviews can come up very quickly (it is not unheard of that the headhunter would ask someone to come in for a first round interview within the next week) but it can also take significantly more time to be set up (weeks or even months) depending on the hiring needs of funds for a candidate’s profile. This means that one should be already fully prepared and ready when talking to headhunters and not only think about preparing once one has talked to a given headhunter (also keep in mind that it sends a great signal to the headhunter if you can say that you are ready to interview and could come in for an interview the next day if needed).

Third, you will have a number of additional interviews. Here you will typically meet most if not all members of the team with a bias towards meeting VPs / Directors at the beginning of the process and Partners / the Team Head towards the end of the process. While the former oftentimes focus more stringently on your investment case performance, investing experience, and technical understanding, the latter will go less into the details there and focus more on the personal / fit elements. This however does not mean that you should come unprepared for the latter interviews as partners oftentimes like to ask you for a good investment idea for example to see how you think about investing.

Fourth, you will typically have a case study. This might be at the very beginning of your interviews, in the middle of the process (most common) or even after the formal interview part (the latter more as a “sanity check”). Format wise, it can be an in-house case study (typically between 3-4 hours; can be stand-alone or in the context of a full “Superday” that contains a number of additional interviews on the same day), or a take home case study (you typically have 1 week to complete this even though some firms more recently started introducing deadlines of 24 hours or less to make the results more comparable across candidates which might have different time availabilities during a week).

Finally, once you successfully mastered all those interviews and case studies, you will receive an offer and typically have between a few days and 2-3 weeks to confirm this offer. Note that firms appreciate if you make a fast decision as this underlines your preference and commitment to a given firm. This however means that it is worthwhile for you to do your diligence beforehand to make sure you have your mind made up and can act decisively. The latter is particularly important as headhunters (especially competing headhunters) might try to lure you (and even fast-track you) into other processes once they hear that you have a full-time offer. Keep in mind, a full-time offer at a strong fund serves as a stamp of approval that they (and you) can leverage for other processes (if desired).

If you have any more specific questions, do not hesitate and reach out to us directly!

Stylized Recruiting Process: